How To Find Swing Trade Stocks

Contents

To spot a moving average break, you’ll need to first decide what timeframe you want to look at. Swing trading involves capitalizing on potentially large price movements that happen over a few days or a few weeks. Swing traders can use a number of different strategies to spot opportunities, but most traders rely heavily on technical indicators like moving averages to find trades.

Apple’s products are distributed online as well as through company-owned stores and third-party retailers. The company generates roughly 40% of its revenue from the Americas, with the remainder earned internationally. The construction stock has a market cap of $87 billion and an EPS of $7.45. Caterpillar has high liquidity and trades more than 2.1 million shares per day and generated revenue $53 billion in 2019.

A catalyst is an important factor to consider when swing trading. It can be news about an upcoming event, information concerning potential changes within a company, or any other credible rumors. Catalysts can identify stocks with the potential for short-term price movements that may not be as obvious in long-term investments. Sectors matter little when swing trading, nor do fundamentals. This is not investing for the long term, so technical signals matter more than price ratios and debt loads. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade.

By comparison, day trading works on short-term time frames and positions are closed by the end of the day whereas swing trading works on medium-term time frames. The first element we want to see for our simple trading strategy is that we need to see the stock price moving into overbought territory. Any swing trading strategy that works should have this element incorporated.

The specific screener you set up is dependent on your strategy. But for swing trading in particular, momentum-based indicators are typically your biggest asset. That’s because you’re just looking to capitalize on price swings – you don’t care too much about the actual performance of a stock.

Day traders can find themselves doing all the work, and the market makers and brokers reap the benefits. Day traders are in and out of trades within minutes or hours. Swing trading can be a means to supplement or enhance a longer-term investment strategy. Swing trading is one of the few ways traders attempt to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace.

The Absolute Bhttps://topforexnews.org/th Index is a market indicator used to determine volatility levels in the market without factoring in price direction. If you don’t want to be trading penny stocks, make sure you filter stocks based on price. Liquidity, for the most part, is a function of the volume of the stock transacted each day. Be sure to choose only stocks that trade at least 500,000 shares per day.

Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations. In addition to diverse, deep-dive research articles, Seeking Alpha’s website has fundamental analysis tools, a Trending News feed, crowdsourced debates, and market data. Reading different opinions about the same stock helps investors develop their own informed opinions on the likelihood a stock will rise or fall. I recommend this approach when learning how to research stocks. The service provides 24 options picks per year, or 2 winning trade ideas each month under the Benzinga Options Starter package. You also can customize solutions to fit your trading style and build and backtest trading strategies.

Historic Conditions:

But most brokers won’t even let a 4th-day trade execute — and you could be stuck holding the bag. Weigh these risks against the rewards that might be out there before making that next trade. Day trading might sound like a fun way to make a living, but it’s a hard game for new traders to break into. Not only do day traders need high-tech stock scanners to locate stocks with potential, but the Financial Industry Regulatory Authority has strict rules in place limiting who can day trade.

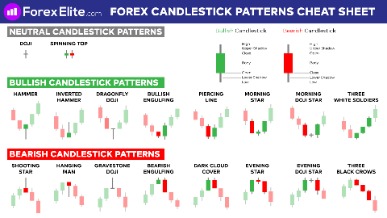

Each average is connected to the next to create a smooth line which helps to cut out the ‘noise’ on a stock chart. The length used can be applied to any chart interval, from one minute to weekly. SMAs with short lengths react more quickly to price changes than those with longer timeframes.

Relative Strength

Available exclusively in MetaStock, patent-pending technology provides a new and unique way to view probable price direction for securities. The tool offers a probability-weighted, easy-to-read picture of the future. The service blends statistics with proprietary math to help you more precisely set profit targets and stops. Leverage scanner and charting capabilities to get customized movement updates in the stock market. News Squawk – Benzinga has a team that calls out actionable news during pre-market all the way through after hours. Market sentiment — is the overall feeling or tone of investors based on trading activity.

- This equipment includes diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives.

- Get actionable tips and updates on swing trading every week in IBD’s Swing Trading column.

- For example, traders can utilize the 9-, 13-, and 50-day EMAs to look for crossover points.

- Previously, Salesforce was not among the best choices for swing traders.

- Swing trading and day trading appear similar in some respects.

I also included a ratio of gold stocks versus gold, and gold and oil. Access a user-friendly platform and app to enjoy easy, low-cost trading. Caterpillar Inc. is the world’s largest manufacturer of construction and mining equipment.

What are some common swing trading indicators?

Meanwhile, https://forex-trend.net/ traders have to be wary that a stock could open significantly different from how it closed the day before. Are you looking for an investing strategy that allows you to take advantage of short-term stock movements? Swing trading allows investors to capitalize on stocks that are in a trading range, with the goal of buying low and selling high. In this article, we’ll discuss how to find stocks for swing trading and provide some tips and strategies to help get you started. The stock’s price action is bouncing in a certain range but never getting too far from a specific value. Holding this stock long-term may not generate a lot of profit if nothing changes.

They tell me the condition of the stock market overall, and whether it’s a good time to swing trade individual stocks. With the right guidance and education, anyone can become a successful swing trader by 2023 and beyond. If you’re ready to do some research and take some calculated risks, swing trading might be the right choice for you. Caterpillar Inc. is an ideal stock for swing traders in 2023 due to its stability and financial strength. Volatility is an important factor to consider when swing trading. High-volatility stocks are generally more profitable in the short term since they tend to experience bigger price fluctuations.

Volume indicators — a very useful tool in showing trading activity that lets you see how many shares are being traded in real-time. Day trading refers to buying and selling a stock within one day. So when I was loosing money every month, it was very painful. For example a big loss is more painful than failing/flunking in 2–3 subjects in school/college.

A https://en.forexbrokerslist.site/ trading plan will work in all markets starting from stocks, commodities, Forex currencies, and much more. If you are interested in learning about other methods of trading our Trading Strategy master post is a great resource. The ideal target for swing trading is 5-10% profits per stock. In order to take advantage of short-term price changes, this strategy requires traders to hold their positions for less time than long-term investors.

You may not have the leverage you need for such short-term trades. Company About Discover how we’re making the markets work for all investors. This set of swing trading rules were first adopted and developed by the author of “The Master Swing Trader,” Alan Farley. The reason why we take profit here is quite easy to understand.

This would ensure that you can always buy or sell your couple of hundred or thousand shares whenever you trade. Start swing trading to potentially profit from your trading edge. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

However, the company has found a way to impress everyone concerned with moves like the Slack takeover (the $27.7 billion deal) and the COVID-19 “Vaccine Cloud”. These have drawn traders’ attention towards Salesforce, making it an attractive swing trade option. This, in its turn, has affected earnings for corporations like Microsoft. With the company’s $168 billion revenue in 2021, this high-tech legend is one of the most attractive choices for swing traders.

The critical thing here is that you need to be able to establish and exit a position relatively swiftly. The index has been uptrending for the better part of a year at this point, but we just saw a pretty significant pullback below the 20-week moving average. If we want to go swing trade on the long-side, we want to find stocks that have been advancing and vice versa. Swing trading enables you to capture a much larger piece of a market move compared to day trading, but also leaves you open to overnight risk.